We offer life insurance products from over 40 companies in the US. We like to provide company reviews for consumers on many of the companies that we work with. In this blog we will be discussing Foresters Financial. The company has been around for many years and has an excellent reputation for taking care of its clients. We will give a brief background of the company and discuss two of its popular life insurance products; Your Term Life Insurance and Plan Right Whole Life product that is designed to help with final expenses. Here is our Foresters Life Insurance Company Review.

We offer life insurance products from over 40 companies in the US. We like to provide company reviews for consumers on many of the companies that we work with. In this blog we will be discussing Foresters Financial. The company has been around for many years and has an excellent reputation for taking care of its clients. We will give a brief background of the company and discuss two of its popular life insurance products; Your Term Life Insurance and Plan Right Whole Life product that is designed to help with final expenses. Here is our Foresters Life Insurance Company Review.

Stents have become quite common these days to treat cardiovascular disease. In fact, almost 1 million stents are placed each year in the US. If you’ve had a stent or multiple stents placed, you probably think that you can’t get life insurance. The good news is that you may qualify for affordable life insurance rates if you’ve had a stent procedure. But before you apply for life insurance with a stent, make sure you understand exactly what the life insurance company needs to know in order to make a decision on your case. Here is everything you need to know about life insurance for people with stents.

Stents have become quite common these days to treat cardiovascular disease. In fact, almost 1 million stents are placed each year in the US. If you’ve had a stent or multiple stents placed, you probably think that you can’t get life insurance. The good news is that you may qualify for affordable life insurance rates if you’ve had a stent procedure. But before you apply for life insurance with a stent, make sure you understand exactly what the life insurance company needs to know in order to make a decision on your case. Here is everything you need to know about life insurance for people with stents.

A little more than a year ago, we compiled our list of the Top 10 Best Life Insurance Companies. Many things have changed in the industry since then. Rates have changed and new products have come to the market. Because of these changes, we decided to offer an updated list of the Top 10 Best Life Insurance Companies for 2017. Our list considers a number of different factors such as rates, underwriting strengths, product features, product offerings and financial strength. Keep in mind that each company has its own particular strengths, so our list below is in no particular order.

A little more than a year ago, we compiled our list of the Top 10 Best Life Insurance Companies. Many things have changed in the industry since then. Rates have changed and new products have come to the market. Because of these changes, we decided to offer an updated list of the Top 10 Best Life Insurance Companies for 2017. Our list considers a number of different factors such as rates, underwriting strengths, product features, product offerings and financial strength. Keep in mind that each company has its own particular strengths, so our list below is in no particular order.

SBLI Accelerated Underwriting Term Life Insurance Review

SBLI Accelerated Underwriting Term Life Insurance Review

Fully underwritten life insurance can take months for approval in many cases. SBLI has created one of the strongest accelerated underwriting term life insurance products on the market today. SBLI’s accelerated underwriting term life insurance product offers a simple application process which is fully underwritten but offers quick approval time and rates that are competitive. If you are looking for life insurance coverage of $500,000 or less and you want a simple application process, you really need to give serious consideration to SBLI’s accelerated underwriting term life insurance. Here is our SBLI accelerated underwriting term life insurance review.

Most life insurance applicants know that life insurance underwriting involves many health related questions as well as an abbreviated medical exam. After all, your overall health is the major determining factor of your health class rating. Did you know that in addition to your overall health, life insurance companies will review many more factors such as your occupation, hobbies and even your driving record? The goal is to better determine if you’re a risky applicant. In this post, we will focus on how your driving record affects your life insurance rates.

Most life insurance applicants know that life insurance underwriting involves many health related questions as well as an abbreviated medical exam. After all, your overall health is the major determining factor of your health class rating. Did you know that in addition to your overall health, life insurance companies will review many more factors such as your occupation, hobbies and even your driving record? The goal is to better determine if you’re a risky applicant. In this post, we will focus on how your driving record affects your life insurance rates.

Buying life insurance to protect your loved ones is one of the most responsible things you can do. Unfortunately, shopping for life insurance can be a little intimidating for some. What kind of life insurance should you purchase? How much do you need? Which company should you use? These are some of the most common questions that people ask when shopping for coverage. We will list the top 15 most commonly asked questions about life insurance that we come across when speaking to customers. Hopefully, our list will help make the buying process for life insurance easier for you.

Buying life insurance to protect your loved ones is one of the most responsible things you can do. Unfortunately, shopping for life insurance can be a little intimidating for some. What kind of life insurance should you purchase? How much do you need? Which company should you use? These are some of the most common questions that people ask when shopping for coverage. We will list the top 15 most commonly asked questions about life insurance that we come across when speaking to customers. Hopefully, our list will help make the buying process for life insurance easier for you.

According to the American Cancer Society, one in six men will be diagnosed with some form of prostate cancer. The good news is that prostate cancer is one of the most treatable forms of cancer and has a very high survival rate. When you are shopping for life insurance with prostate cancer, it is important to understand how life insurance companies will rate your case. They will look at factors such as your age of diagnosis, stage of cancer, treatment received, your PSA and any other health factors. Here is what you need to know about life insurance with prostate cancer.

According to the American Cancer Society, one in six men will be diagnosed with some form of prostate cancer. The good news is that prostate cancer is one of the most treatable forms of cancer and has a very high survival rate. When you are shopping for life insurance with prostate cancer, it is important to understand how life insurance companies will rate your case. They will look at factors such as your age of diagnosis, stage of cancer, treatment received, your PSA and any other health factors. Here is what you need to know about life insurance with prostate cancer.

Honesty on Your Life Insurance Application is the Best Policy

Honesty on Your Life Insurance Application is the Best Policy

When you apply for life insurance, a good part of your life is put under the microscope during the underwriting process. Insurance companies will look at everything from your health to your hobbies. Life insurance companies leave no stone unturned when determining your health class rating so it is best to always tell the truth on your application. If the life insurance company feels that you have lied or misrepresented yourself on your application, they could refuse to pay your death benefit if you pass away. Here’s why Honesty on your life insurance application is the best policy.

Buying Life Insurance on Your Parents

Buying Life Insurance on Your Parents

If you will burden some financial responsibility after your parents pass away, buying a life insurance policy on your parents could give you the financial resources to take care of final expenses, medical expenses, or any other debts that you may have to deal with when settling your parents’ estate. Before you consider buying life insurance on your parents, there are a few important things that you must consider. In this article, we will show you how to go about buying life insurance on your parents and if it makes sense.

Table Shave and Underwriting Credits for Term Life Insurance

Table Shave and Underwriting Credits for Term Life Insurance

Life insurance underwriting involves many different moving parts. You are assessed on many health and lifestyle characteristics so that the underwriters can determine your health class rating. In many cases, there are applicants who have minor to moderate health issues but are otherwise healthy. For instance, if you are overweight, your build might put you in a ‘Standard’ health class. But what if all your other health and lifestyle characteristics fall into the ‘Preferred’ health class? In this case, some life insurance companies will offer health and lifestyle credits that will push you up to a ‘Preferred’ or even ‘Preferred Best’ health class, saving you thousands over the life of your policy.

Life Insurance for Foreign Nationals

Life Insurance for Foreign Nationals

If you’re a foreign national, you could have access to U.S. life insurance. Life insurance for foreign nationals can provide access to highly rated U.S. companies, U.S. dollar denominated coverage and a diverse choice of products not found in other countries. Life insurance planning for foreign nationals could also offer valuable tax advantages that can be used for estate planning, business planning and income replacement to name a few. Here’s what you need to know about life insurance for foreign nationals.

Life Insurance Options at Age 65 or Older

Life Insurance Options at Age 65 or Older

There are a number of scenarios that would require those who are 65 or older to need life insurance. Applying for life insurance at age 65 could be tricky if you have health issues or if you’re not sure what kind of product will be the best fit for your situation. Our goal us to show you several options so that you can make an educated decision when it comes time to purchase coverage. If you are 65 or older, you should know your options when it comes to life insurance. Here is what you need to know about your life insurance options at age 65 older.

How Some Life Insurance Ads Mislead Consumers

How Some Life Insurance Ads Mislead Consumers

We are constantly bombarded by life insurance ads online and on television that make promises of low rates and guaranteed coverage. If a life insurance offer looks too good to be true, there is usually some fine print that explains the conditions of the offer. Our goal is to make sure consumers know what to look for when they see these types of advertisements. We took a look at a few ads that we saw online and showed how they could be a bit misleading. Here is what you need to know about how some life insurance ads mislead consumers.

Are Your Loved Ones Protected?

Life Insurance Awareness Month, September 2016

Every September, Life Happens sponsors Life Insurance Awareness Month. It’s an opportunity to raise awareness for the importance of life insurance. Most people don’t like to think about life insurance. Mostly because it means that you have to think about your mortality. But the fact is that buying life insurance to protect your family is one of the most generous and responsible things you can do as a parent or spouse. There is no better time to buy life insurance than right now. Term life insurance rates have declined substantially and the application process for life insurance has never been easier. Here are some important facts you need to know about life insurance.

Life Insurance for Smokeless Tobacco, Vape, Pipe and e-Cigarette Users

Life Insurance for Smokeless Tobacco, Vape, Pipe and e-Cigarette Users

If you didn’t already know it, life insurance coverage for tobacco users costs much more than coverage for those who do not use tobacco. In most cases, it will be more than double the cost. But how do life insurance companies define “tobacco use”. Most of the companies out there are very strict when it comes to underwriting applicants who use tobacco. They only offer smoker rates for applicants who use ANY kind of tobacco. The good news is that there are a handful of life insurance companies out there that will allow non-smoker rates for those who use smokeless tobacco, pipes, vapes and e-cigarettes. Here is what you need to know about life insurance for smokeless tobacco, pipe, vape and e-cigarette users.

How to Reduce Your Taxes Using Life Insurance

If you think that taxes are going to be higher in the future, you might want to start thinking ahead. Life insurance is an excellent tax planning tool if used properly. Funding a permanent life insurance policy that is structured for efficient cash value growth could allow you access to tax-free withdrawals in the future. If tax rates increase in the future, using life insurance to fund part of your retirement plan could save you thousands in taxes. In this post we will explain how to reduce your taxes using life insurance.

How to Choose the Right Life Insurance Company

How to Choose the Right Life Insurance Company

With so many life insurance companies to choose from, finding the right company for your situation can be a bit overwhelming. It is important to choose the right life insurance company considering the fact that you will most likely have your life insurance policy for a long time. Choosing the wrong company could lead to paying higher premiums than necessary and other problems the down the road. We’ve outlined some improtant factors to consider that will help make the decision process easier when determining how choose the right life insurance company.

5 Star Life Insurance Term to 100 Review

5 Star Life Insurance Term to 100 Review

If you’re looking for an alternative to a fully underwritten life insurance policy, 5 Star Life Insurance Term to 100 could be right for you. 5 Star Life insurance offers term life coverage that lasts to age 100 without a medical exam. In fact, there are only a handful of medical questions that need to be answered and approval is immediate. But before you consider the 5 Star Life Insurance Term to 100 policy, let us give you all of the details so you can make an informed decision. Here is our 5 Star Life Insurance Term to 100 Review.

Now is the Best Time to Buy Term Life Insurance

There has never been a better time to buy term life insurance. It seems almost every month we are getting a notice that some company has dropped its rates. Most companies are trying their best to provide the most competitive rates in order to get more market share. This is great news for consumers as term life insurance rates have never been lower. Not only that, many life insurance companies have tried to streamline their application and underwriting processes to make the process of purchasing life insurance easier for consumers. Here is why now is the best time to buy term life insurance.

Life Insurance for Newlyweds

Life Insurance for Newlyweds

Getting married is one of the biggest milestones in life and one of the biggest reasons to start looking at life insurance coverage. Once you are married, you are now planning everything as a couple rather than as individuals. It is also most likely that you are going to be taking on more responsibilities such as buying a home and starting a family. Life insurance should be the cornerstone of your financial plan. Here’s what you need to know about life insurance for newlyweds.

The 60 Minutes Report on Life Insurance Shouldn’t Deter You from Buying Coverage

The 60 Minutes Report on Life Insurance Shouldn’t Deter You from Buying Coverage

In case you missed it, last Sunday 60 Minutes revealed a scathing report about the life insurance industry. The report revealed that some of the most well-known insurance companies are not properly reporting and paying out unclaimed life insurance policies. This report is a black eye to the industry and sure to leave a bad taste in the mouths of consumers who are shopping for life insurance. But before you decide to put off buying life insurance coverage, it is important to understand all of the facts.

8 Reasons Why Millennials Should Consider Life Insurance

If you’re a millennial, buying life insurance is probably one of the last things on your mind. Most millennials today are focused on their careers and financial independence first and settling down and starting a family later. But even though most millennials don’t have families to support, buying life insurance could make sense in many cases. Here are 8 Reasons Why Millennials Should Consider Life Insurance.

Primerica Life Insurance Review

Primerica Life Insurance Review

If you are considering a term life insurance policy from Primerica or you already have one, you might want to read our review. With all of the choices you have for term life insurance coverage, it makes sense to shop around before considering a policy from Primerica. You will find that Primerica’s term life coverage is not competitive with other companies and lacks a very important feature found with almost all term policies. In this post we will talk about how Primerica’s term life product stacks up to the competition.

6 New Year’s Resolutions to Consider for Your Life Insurance Coverage

6 New Year’s Resolutions to Consider for Your Life Insurance Coverage

It’s the time of year when everyone makes their New Year’s resolutions. For many, resolutions usually include setting new financial goals. This could include saving more in your 401k, reducing your debts or making sure you and your loved ones are adequately protected with life insurance. If you are looking at your overall financial picture, it is important to think about adding life insurance to your strategy. If you already have life insurance, it makes sense to take another look at what you have. Here are 6 New Year’s resolutions to consider for your life insurance coverage.

Raising a family is the most rewarding challenge parents can face. You now share the goals and responsibility of protecting your loved ones. Adequately protecting your loved ones requires proper planning. Who will take care of your children if you are not able to do so? Will you have enough money to send them to college? It is important to answer these questions and more when planning for your family’s future. Here are some simple steps you can take to make sure that you are on the right track to protecting your loved ones.

Uninsurable Medical Conditions for Life Insurance

Life insurance underwriting has come a long way over the years. As medicine and medical technology in general have improved over time, it has become somewhat easier to get affordable life insurance rates with moderate health issues. That’s the good news. The bad news is that in certain instances, you will automatically be declined for life insurance if you have certain medical conditions. Before you consider applying for life insurance, it is important to know if your medical condition makes you uninsurable. Here is a list of some medical conditions that could make you uninsurable for life insurance.

Life Insurance and Bankruptcy

Filing for bankruptcy is sometimes the best and fastest way for a debtor to recover from a financial hardship. Most people don’t know that a bankruptcy on your credit report could make you uninsurable in certain cases when it comes to life insurance. It really depends on the type of bankruptcy and whether or not it has been discharged. If you have a bankruptcy on your credit report, you need to know your options when applying for life insurance. Our post will explain the important factors you need to know about life insurance and bankruptcy.

20 Terms You Should Know When Shopping for Term Life Insurance

As you research your life insurance options, you might come across various life insurance terms that you haven’t heard before. Our goal is to educate consumers about life insurance so that they can make an informed decision when they are ready to purchase coverage. We decided to list 20 terms you should know when shopping for term life insurance so that you are better informed when researching your coverage options. Knowing these terms will make the process of purchasing life insurance a bit less intimidating.

Is it Time to Review Your Existing Life Insurance Coverage?

Most people buy life insurance and simply never think about reviewing their coverage or needs again. The fact is that you should periodically review your existing life insurance coverage to make sure that it is meeting your objectives. The life insurance industry has changed and is continuing to change for the better. Life insurance rates have been on the decline, life insurance companies have become better at underwriting health impairments and life insurance products have evolved. If you own a life insurance policy, it might be a good time to review your coverage and coverage goals. Here are some things you need to think about when it’s time to review your existing life insurance coverage.

Life Insurance and Alcoholism

If you’re a recovering alcoholic and you are looking for life insurance coverage, the good news is that coverage is available in many cases. The bad news is that life insurance companies are pretty strict in how they view alcohol usage. Not only are there health risks associated with heavy alcohol usage, but there are also lifestyle risks as well. The key is to find the life insurance company that will be the right fit for your particular situation. If you regularly use alcohol or you are in alcohol recovery, you should be aware of your life insurance options. Here is what you need to know about life insurance and alcoholism.

When Should You Consider Annual Renewable Term Life Insurance?

When most people sit down to decide how long they need term life insurance coverage, the typical thought is to go out 20 or 30 years. In most cases, a 20 or 30 year policy will ensure coverage lasts until retirement, the mortgage is paid off or children are no longer financially dependent. Locking in a rate for the long term is usually the best way to go. But what if you only need coverage for a short period of time? What if you can’t afford to buy a 20 or 30 year policy at the moment but you still need coverage? Luckily, you could opt for annual renewable term life insurance (ART). In this post, we will explain when you should consider annual renewable term life insurance.

Top 10 Best Life Insurance Companies

Top 10 Best Life Insurance Companies

According to Archstoneinsurance.com

At ArchstoneInsurance.com, we have access to over 40 of the top life insurance companies in the industry. Although we consider all of these companies quality insurers, over time we have isolated our list of top 10 best life insurance companies. We considered a number of different factors such as cost, underwriting strengths, product features, product offerings and financial strength. Below is a list our list of top 10 best life insurance companies and the pros and cons to working with each. Keep in mind that each company has its own particular strengths, so our list below is in no particular order.

Which Type of Term Life Insurance is Right for You?

Which Type of Term Life Insurance is Right for You?

When it comes to term life insurance, you have a few different choices. If cost is the main driver in your decision, you could simply purchase the most economical option as your choice. A simple term policy that covers you until your children are grown or until you retire might be sufficient. If you are looking for more comprehensive coverage, a term product that offers additional features such as return of premium, living benefits or the potential for lifetime coverage could make sense. To make the decision process a little easier, we have decided to offer a list of term life insurance options that fulfill a wide spectrum of coverage needs and goals. Which type of term life insurance is right for you?

Life Insurance Awareness Month – September 2015

Life Insurance Awareness Month – September 2015

Every September, LifeHappens.org sponsors Life Insurance Awareness Month. As the name suggests, the campaign is aimed at showing consumers, especially parents, the importance of life insurance coverage. With the kids back in school, now is an excellent time to review your life insurance needs and your existing coverage if you already have it. Life insurance offers affordable protection that could save your family from financial devastation if you passed away unexpectedly.

Should You Buy Life Insurance for Your Children?

Should You Buy Life Insurance for Your Children?

If you’re a parent who has loved ones that rely on you financially, it is pretty much a no brainer that you should own life insurance. Life insurance allows you to take care of your loved ones if you are not around to provide for them. But should you buy life insurance for your children? Buying life insurance for your children can make sense in some instances. It will all come down to your particular circumstances and goals for providing the coverage. In this post we will look at the benefits and drawbacks to buying life insurance for your children.

Life Insurance With Multiple Sclerosis

Life Insurance With Multiple Sclerosis

If you have multiple sclerosis, you might think that it is difficult or impossible to get life insurance. The good news is that you can get life insurance with multiple sclerosis. Your final health rating will ultimately depend on the severity of your multiple sclerosis. Since each life insurance company has its own underwriting guidelines, it is important to shop your case to find the company that will give you the best rating for your particular situation. Here is what you need to know about life insurance with multiple sclerosis.

How Does Indexed Universal Life Insurance Work?

How Does Indexed Universal Life Insurance Work?

Indexed universal life insurance (IUL) has become one of the most popular permanent insurance products on the market today. The appeal is that indexed universal life insurance offers the best of both worlds – the potential for upside gain that is linked to stock market returns with downside protection from investment losses. If you are considering an IUL policy, you need to know all of the facts. In this post, we will take an objective look at indexed universal life insurance and show you what to look for in an IUL policy.

10 Important Questions to Ask Yourself Before Buying Life Insurance

10 Important Questions to Ask Yourself Before Buying Life Insurance

Most people have no idea where to start when buying life insurance. Through our website and blog, we try to provide consumers with the information they need to make the process of buying life insurance easier. Sometimes the best way to figure out your goals for life insurance is to ask yourself these 10 important questions before you consider a policy. You can do this yourself or you can discuss them with an agent who can help you build a strategy that is right for you. Here are 10 important questions to ask yourself before buying life insurance.

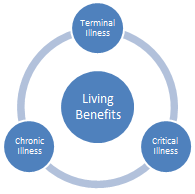

Term Life Insurance with Living Benefits

Term Life Insurance with Living Benefits

One of the biggest knocks on term life insurance is that it only offers a benefit if you die. In other words, there are no living benefits while the policy is in force. Although that is the case for many term life insurance policies on the market today, there are some companies that offer term coverage that also includes benefits should you become terminally ill, chronically ill or suffer a critical illness. If you are looking for a term life policy with more comprehensive coverage, a policy with living benefits might make sense. Here is a general overview of term life insurance with living benefits.

Life Insurance if You Already Have an Existing Health Condition

Life Insurance if You Already Have an Existing Health Condition

Some people might be apprehensive about applying for life insurance coverage if they already have existing health condition. Many feel that their condition will make rates too expensive or that they are uninsurable altogether. The good news is that in many cases affordable life insurance rates are attainable even if you have a pre-existing health condition. Life insurance companies have come a long way in underwriting applicants with chronic illnesses, but it is important to know how you will be evaluated. Here is what you need to know about life insurance if you already have an existing health condition.

Think You Can’t Afford Life Insurance? Maybe You’re not Making it a Priority.

Think You Can’t Afford Life Insurance? Maybe You’re not Making it a Priority.

One of the most common reasons why people don’t own life insurance is because they think they can’t afford it. The fact is that life insurance rates have never been lower. In most cases, the problem isn’t that life insurance is too expensive but that people simply don’t make it a priority in their budget. It’s easy to get fixated on owning the latest smartphone or indulging in that daily latte, but when you really think about it, what is more important than protecting your loved ones? The fact is that there is a life insurance option for almost any budget. Think you can’t afford life insurance? Maybe you’re not making it a priority in your budget.

Product Review: American General Secure Lifetime GUL II

Product Review: American General Secure Lifetime GUL II

If you are looking for lifetime coverage at an affordable price, American General’s Secure Lifetime GUL II might be the right fit for you. The Secure Lifetime GUL II offers some unique features that set it apart from the competition. The product is also one of the least expensive guaranteed universal life options available on the market. It is truly a comprehensive product that can be designed to offer protection if you die to soon, live too long or get sick along the way. Here is our review of American General’s Secure Lifetime GUL II.

Life Insurance for Military Personnel

Life Insurance for Military Personnel

For those in the military who risk their lives to protect our freedom, it is important that they are provided with affordable life insurance options without any major restrictions. If you are in the military, we want to make sure that you know all of your best options for life insurance coverage. Government sponsored programs offer limited coverage amounts and many commercial life insurance companies restrict coverage for active military personnel. In this post we will talk about life insurance options for military personnel and how to get the best rates for coverage. Here is what you need to know about life insurance for military personnel.

Still Don’t Have Life Insurance? What Are You Waiting For?

Still Don’t Have Life Insurance? What Are You Waiting For?

Still don’t have life insurance coverage? The good news is that now is an excellent time to get covered. We were recently notified that American General reduced the price of its already affordable Select-a-Term product. Other companies have also cut rates on term life insurance over the past year as well, including SBLI and John Hancock. The fact is that term life insurance rates have never been more affordable. A simple level term policy could help your loved ones replace your income and pay necessary expenses in the event that you are not around to provide for them. Still need convincing? Take a look at the statistics below. How would your loved ones cope with these obligations?

Life Insurance Planning for Parents of Children with Special Needs

Life Insurance Planning for Parents of Children with Special Needs

The greatest concern for parents of a child with special needs is the uncertainty of what will happen when they are no longer able to care for the child after their deaths. If you have a child with special needs, it is important to make sure your child has the funding needed to receive the quality of care you would want for them after you are gone. Life insurance can play an important role in providing these funds. Here are some important facts that you need to know about life insurance planning for children with special needs.

Life Insurance with Crohn’s Disease

Life Insurance with Crohn’s Disease

If you suffer from Crohn’s disease and are in need of life insurance, you should be happy to know that affordable rates are available. Ultimately, your rate will depend on the severity of your particular condition. Life insurance companies focus on a few key factors when it comes to determining your health class rating for Crohn’s disease. The key to finding the best life insurance rates for Crohn’s disease is to shop your case to find the company that will view your particular situation most favorably. Here is what you need to know about life insurance with Crohn’s disease.

Life Insurance After Retirement

Life Insurance After Retirement

For most people, the need for life insurance ends at retirement. If life goes according to plan, by the time you retire your children will be self-sufficient, your home will be paid off, you will have a retirement nest egg saved and you will be able to collect social security. Unfortunately, life doesn’t always go according to plan. Circumstances could change which would make owning life insurance after retirement a smart move. Here are some scenarios where owning life insurance after retirement might make sense as well as some coverage options.

Protective Life Insurance Company Review

Protective Life Insurance Company Review

Clients often want to know which life insurance company we think is the best. That is a difficult question to answer because there are so many variables that should be considered such as product offerings and features, financial ratings, cost of coverage and underwriting strengths. One company that is competitive in almost all of these areas is Protective Life Insurance Company. In this post we will provide a review of Protective Life and tell you why we think it is one of the best all-around life insurance companies out there.

Product Review: Alumni Insurance Program Life Insurance

Product Review: Alumni Insurance Program Life Insurance

You may have seen an ad in your alumni association newsletter or on its website for the Alumni Insurance Program (AIP). This is a program that offers life, health and other types of insurance plans to more than 300 alumni associations. You might think that buying life insurance through your alumni program will save you money, but in most cases it doesn’t. We took a look at the Alumni Insurance Program’s life insurance offerings and compared the rates and features to individual plans outside of the program. Here is our review of the Alumni Insurance Program’s life insurance offerings.

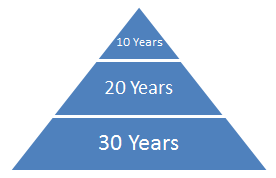

Layering Life Insurance Policies for Big Savings

Layering Life Insurance Policies for Big Savings

A great way to save money on your life insurance coverage is to layer your policies. Layering your life insurance policies could save you thousands over the life of your coverage. The strategy is pretty simple. In most cases, your need for life insurance diminishes as you get older. By layering your policies, you can structure your coverage so that it decreases as your need for life insurance decreases. This is done by purchasing multiple policies with different durations. This strategy can offer substantial savings compared to buying one long-term policy. But before you consider layering your life insurance coverage, we want you to know all of the facts. This post will discuss how to layer coverage and the benefits and drawbacks to doing so.

Life Insurance with Bipolar Disorder

Life Insurance with Bipolar Disorder

According to the National Institute of Mental Health, roughly 5.7 million people in the United States suffer from bipolar disorder. Bipolar disorder can be a debilitating mental health issue if left untreated. But for those who are being treated for bipolar disorder, it can mean a normal, productive life. If you are looking for life insurance with bipolar disorder, you will be happy to know that affordable coverage is available in many cases. Your final health rating will depend on a number of factors surrounding the severity of your particular situation. In this post we will discuss what factors life insurance companies focus on when assessing applicants with bipolar disorder and what rating you can expect for life insurance with bipolar disorder.

Guide to Buying Life Insurance Online

Guide to Buying Life Insurance Online

The life insurance industry has evolved quite a bit over time. In the past, the process of buying life insurance usually meant visiting a local agent’s office and buying whatever product their company offered. In other words, your choices were limited in terms of advice and products. The internet has completely changed the landscape for buying life insurance – in a good way. The internet has now given consumers online tools to educate themselves and comparison shop before even speaking to an agent. This post will show you what to consider when buying life insurance online.

Product Review: Gerber Guaranteed Issue Life Insurance Plan

Product Review: Gerber Guaranteed Issue Life Insurance Plan

When most people hear the name Gerber, they think baby food. But the fact is that Gerber also offers insurance products through its affiliate, Gerber Life Insurance. Gerber’s Guaranteed Issue Life Insurance Plan offers a smaller amount of coverage that could be a great fit for those looking to cover the cost of final expenses. It offers a simple application with no health or medical questions and guaranteed approval. But before you consider Gerber’s guaranteed issue product, we want you to know all of the facts. In this post we will review the Gerber Guaranteed Issue Life Insurance Plan to help you determine if it is the right plan for you.

How Does Guaranteed Universal Life Insurance Work?

How Does Guaranteed Universal Life Insurance Work?

Guaranteed universal life (GUL) insurance has been generating quite a bit off buzz in recent years since it offers lifetime coverage that is more affordable than whole life or traditional universal life products. To many, this might seem like the best of both worlds – affordable premiums and lifetime coverage. But before you consider a GUL policy it is important to understand exactly how it works. In this post we will explain how GUL insurance works as well as its benefits and drawbacks.

Is the Federal Employees’ Group Life Insurance Plan (FEGLI) Worth It?

Is the Federal Employees’ Group Life Insurance Plan (FEGLI) Worth It?

Federal Employees’ Group Life Insurance plan or FEGLI for short is the largest group policy in the world, covering 4 million Federal employees and retirees, as well as many of their family members. Like other group policies, it allows employees to enroll in life insurance coverage without a medical exam. Group policies can be tempting because of the limited underwriting and the convenience of having premiums deducted right from your paycheck, but in most cases an individual policy will always be a better bet. In this post, we will help you decide if the Federal Employees’ Group Life Insurance Plan (FEGLI) is Worth It.

Converting Your Term Life Insurance Policy to Permanent Coverage

Converting Your Term Life Insurance Policy to Permanent Coverage

Most people overlook the importance of the conversion provision in their term life insurance policy. The conversion provision allows the term policyholder the opportunity to convert their term coverage to permanent coverage without proof of insurability. You might be wondering why you would ever need to convert your term coverage to permanent coverage. The fact is that there are several situations where a conversion would make a lot of sense. Here is what you need to know about conversion provisions and the process of converting your term life insurance policy to permanent coverage.

Life Insurance with Sleep Apnea

Life Insurance with Sleep Apnea

Sleep apnea affects more than 18 million people in the US, according to the National Sleep Foundation. It can cause serious health issues if left untreated. Underwriting life insurance with sleep apnea can be tricky, with health ratings ranging from the best available to being declined coverage altogether. Life insurance companies are very specific about what they look for in applicants with sleep apnea. If you are looking for life insurance with sleep apnea, it is important to work with an agent who knows which companies will rate your sleep apnea most favorably. Here is what you need to know about life insurance with sleep apnea.

Life Insurance and the Medical Information Bureau

Life Insurance and the Medical Information Bureau

If you’ve applied for life insurance in the last 7 years, the Medical Information Bureau (MIB) most likely has a file on you. You probably didn’t know that such a file existed or that the MIB existed for that matter, but the MIB plays an important role in the life insurance industry. It allows member insurance companies to exchange underwriting information between one another in an effort to prevent loss due to fraud or omission. But how does the MIB help the industry and consumers?

Life Insurance with High Blood Pressure

Life Insurance with High Blood Pressure

If you have high blood pressure and are afraid that you can’t get affordable life insurance, we have good news for you. Not only can you still get life insurance if you have high blood pressure, but in some cases you can even qualify for the best health rating. It will really come down to how well you are managing your blood pressure and if it is coupled with any other health issues. The key to getting the best rate for life insurance with high blood pressure is finding the company that will view your particular case most favorably. Here is what you need to know about life insurance with high blood pressure.

Product Review – John Hancock Vitality Program

Product Review – John Hancock Vitality Program

John Hancock has teamed up with Vitality to introduce a new innovative life insurance program in the U.S. that integrates wellness rewards with life insurance coverage. The Vitality Program from John Hancock offers policyholders the opportunity to earn rewards for travel, entertainment, shopping and fitness as well as the opportunity to reduce premiums by simply living a healthy lifestyle. If you’re looking for more out of your life insurance coverage, John Hancock’s Vitality Program could be a good fit for you. Here’s how it works.

Life Insurance for Smokers

If you’re a smoker in need of life insurance, it is important to know that each life insurance company has its own criteria for rating smokers. Some companies are no nonsense and will view all applicants who use any type of tobacco products as smokers, while others will be more lenient. In fact, some companies out there will allow the “occasional” tobacco user, non-smoker rates. Smokers will pay much more for life insurance than nonsmokers – usually 3 to 5 times more. The key to finding the best life insurance for smokers is to use an agent who knows which companies view smoking most favorably. Here’s what you need to know about life insurance for smokers.

State Farm Term Life Insurance Review

State Farm Term Life Insurance Review

When you think of State Farm, you probably think of the catchy slogan “like a good neighbor, State Farm is there” or those funny commercials featuring Aaron Rodgers. The fact is that State Farm is one of the most respected names in the industry when it comes to most personal insurance coverage. But we wanted to compare how State Farm’s rates for term life insurance compare to other companies out there. If you are considering buying life insurance through your local State Farm agent, read this blog first. We are going to take a look at how State Farm’s term life insurance stacks up to the competition.

What to Do If You’re Declined for Life Insurance

What to Do If You’re Declined for Life Insurance

In our last post, we discussed common reasons for being declined life insurance. In this post we are going to discuss what to do if you’re declined for life insurance. Being declined for life insurance can be a stressful situation for most people. After all, how will you be able to financially protect your loved ones without life insurance? It is important to know that just because you were declined coverage by one company, that doesn’t mean another company won’t approve you. So if you’ve been declined for life insurance and aren’t sure what to do next, don’t panic. Read on and find out what you need to do if you’ve been declined for life insurance.

Common Reasons for Being Declined Life Insurance

Common Reasons for Being Declined Life Insurance

Life insurance companies are very thorough in their approach to reviewing fully underwritten applicants. They look at many different factors from your health to your hobbies to determine your overall health class rating. If a life insurance company views you as too much of a risk to insure, it will will simply decline your application. It is important to know some of the more common reasons why a life insurance company might decline your application.

Affordable life insurance is an option for those who suffer from asthma. In some cases, those with mild asthma can qualify for preferred best rates. Ultimately, your health rating with the insurance company will depend on the severity of your asthma along with all of your other relevant health factors. Every life insurance company has its own underwriting guidelines for how it rates applicants with asthma. It is important to use an independent agent that can shop your particular case to multiple carriers to find the company that will best rate your asthma situation. Here is what you need to know about life insurance with asthma.

7 Common Life Insurance Myths Debunked

7 Common Life Insurance Myths Debunked

There are so many misconceptions out there surrounding the subject of life insurance that separating fact from myth can sometimes be difficult. It can get so confusing for some that they simply put off obtaining coverage. Since life insurance is essential part of any overall financial plan, we wanted to do our part to clear up any confusion that might be preventing those of you from getting coverage. So we decided to debunk 7 common myths when it comes to life insurance.

Prudential Term WorkLife 65 Review

Prudential Term WorkLife 65 Review

For those of you looking for the complete solution to your term life insurance needs, Prudential’s Term WorkLife 65 product could be the answer. Prudential’s WorkLife 65 product is a comprehensive term policy that offers guaranteed level premium coverage until age 65 with premium payment protection built in if you become unemployed or disabled while your policy is in force. The Work Life 65 product offers affordable rates for a policy that includes several valuable features not found in many term policies. Here’s how it works.

Farmers Term Life Insurance Review

Farmers Term Life Insurance Review

Farmers Insurance has become a household name. It seems that every time we turn on the television we are being barraged with the company’s funny commercials and catchy jingle “We are Farmers!” Farmers Insurance is considered a well-respected insurance company with a history spanning almost 100 years. It has an excellent reputation for providing reasonable rates on home, auto, business and renters insurance. But when it comes to term life insurance, Farmers rates can be substantially higher than its competitors. In this post, we will take a look at how Farmers Value Term Life Insurance rates stack up against the level premium term rates of another highly rated company in the industry.

Is AICPA Life Insurance Worth It?

Is AICPA Life Insurance Worth It?

Like many other member associations, the American Institute of Certified Public Accountants (AICPA) allows its members the opportunity for group rates on various life insurance products. It might be tempting to go the group rate route for most people since it is usually easier to apply and requires less underwriting than traditional fully underwritten policies, but most group policies have drawbacks such as increasing premiums and limits on coverage. In fact, if you are willing to take the time to apply for a fully underwritten policy, you could save thousands over the life of your policy. Here is a look at how the AICPA’s term life insurance plans stack up against fully underwritten individual policies

What Personal Information is Required When You Buy Life Insurance?

What Personal Information is Required When You Buy Life Insurance?

When you apply for life insurance, you are required to provide quite a bit of personal information. While you are filling out the application, you might find yourself asking questions like “why do they need to know my social security number?” or “what does my driving record have to do with life insurance?”. As you can understand, the life insurance company is taking a risk whenever it provides coverage, so it will want to make sure that it has as much information as possible on you before it makes a decision on your health risk rating. This post will discuss the information a life insurance company will need from you in order to process a fully underwritten application and explain why certain personal information is needed.

Options When Your Level Term Premiums are About to Expire

Options When Your Level Term Premiums are About to Expire

When you buy a term life policy, you pay level premiums for the duration of the term such as 10, 15, 20, 25 or 30 years. You might think that your coverage simply runs out at the end of the chosen duration, but that is actually not the case for most term policies. Most term policies will allow you to continue coverage to age 95, but your premiums will increase annually after the level premium duration expires. If you are coming up on the expiration date of your life insurance policy and you still need coverage, you have a few options. Here’s what you need to know if your level term premiums are about to expire.

If you are living with chronic obstructive pulmonary disease (COPD), you are not alone. According to the National Heart, Lung and Blood Institute, more than 12 million Americans have been diagnosed with COPD. It is estimated that another 12 million are thought to have undiagnosed COPD. COPD is a pulmonary disorder that ranges in severity. If you need life insurance but are suffering from COPD, you might think that life insurance coverage is out of the question. The good news is that depending on the severity of your COPD, you might be able to qualify for standard rates. Here’s what you need to know about getting life insurance if you have COPD.

Life Insurance with Anxiety Disorder

Life Insurance with Anxiety Disorder

For those of you who have anxiety, the process of getting life insurance might seem a bit daunting. First off, you probably do not like to talk about your condition no matter how mild or severe it might be even though anxiety disorder is quite common. The other reason is that you might think it could prevent you from getting coverage or make coverage unaffordable altogether, so you don’t even bother applying. The fact of the matter is that those with mild anxiety can get preferred rates and even those with moderate anxiety can still qualify for standard rates. Your health class will ultimately depend on the severity of your anxiety and how it impacts your daily life. Here’s how it breaks down.

United of Omaha’s Fit Program Can Save You Thousands

United of Omaha’s Fit Program Can Save You Thousands

On our blog, we always talk about how we can save people with health impairments money on their life insurance coverage. We know which life insurance companies are most flexible when underwriting certain health issues. We also know which companies allow credits that will improve your final health rating which is important in determining your premium. Through United of Omaha’s Fit Program, you can improve your health rating by two table credit ratings if you have a health impairment but are otherwise healthy and exhibit positive lifestyle habits. This could lead to thousands of dollars in savings over the life of your policy. Here’s how it works.

What Kind of Life Insurance Do You Need?

What Kind of Life Insurance Do You Need?

You have two main choices when it comes to life insurance coverage, term life insurance or cash value life insurance. How do you determine which product is best for your needs? It really depends on your life insurance coverage goals. Before you buy life insurance, you should ask yourself what you want out of your coverage. For some, the main driver might be affordability. For others, the main driver might be coverage that lasts their lifetime. The goal of this post is to get you to think about what features might be important to you when it comes to life insurance coverage and the differences between term life and cash value life insurance coverage.

Sagicor No Exam Term Life Insurance Review

Sagicor No Exam Term Life Insurance Review

Do any of these scenarios apply to you? You need life insurance but you don’t want to deal with being poked with a needle. You need immediate life insurance coverage and you don’t have the time to wait through the full underwriting process. You need life insurance and you don’t have time to take a paramedical exam. If any or all of these scenarios apply to you, Sagicor’s Sage non-medical term product could be the right option for you. It offers affordable term coverage up to $500,00, an easy application process and no medical underwriting. Here’s how it works.

How We Get Our Clients with Health Issues the Best Rates

How We Get Our Clients with Health Issues the Best Rates

Most people with health issues think that they will be declined for life insurance coverage or that they won’t be able to afford the higher rates. This thinking usually discourages them from even inquiring about coverage. In some cases they have trusted an agent who simply sent in an application to one company without a true understanding their case and were declined. If you have medical issues, wouldn’t it be nice to know what you are up against before you even fill out an application? Our process allows us to give our clients with health issues an understanding of their potential rating and premium cost before they even fill out an application. Here’s how we do it.

The Whole Truth About Whole Life Insurance

The Whole Truth About Whole Life Insurance

There is a movement happening in the life insurance industry. It’s called The Whole Life Rebellion. It is a movement to inform and educate consumers about the drawbacks to whole life insurance. Whole life insurance has been touted by many agents as the ultimate life insurance product because it offers lifelong protection, premium predictability and guaranteed cash value growth. But does it truly provide “value” for the hefty premium price tag attached? Before you buy a whole life policy, you should understand the whole truth about whole life insurance to see if it is a good fit for your situation.

Startling Statistics About Life Insurance

Startling Statistics About Life Insurance

LIMRA, a worldwide life insurance research group, issues its Facts of Life report each year which always reveals some very startling data about life insurance ownership in the US. The report shows that although many see the value in life insurance coverage, millions of households go uninsured or underinsured. Life insurance rates have never been more affordable. Life insurance can provide your loved ones with the needed funds to replace your income should you pass away. Here is a breakdown of some of the key facts from recent reports.

Don’t Think It Will Happen to you? Startling Statistics about Death

Don’t Think It Will Happen to you? Startling Statistics about Death

Most people don’t like to talk about death. In fact many people avoid buying life insurance because they don’t like to think about the possibility that they could die prematurely. They think “it won’t happen to me” or “I’m too young to die” so they forgo the needed protection of life insurance. The fact is many people in this country die at an earlier age than their average life expectancy. Here are some statistics that might surprise you.

Why Do Men Pay More for Life Insurance Than Women

Why Do Men Pay More for Life Insurance Than Women

When it comes to life insurance coverage, men pay more than women. It’s nothing personal, just statistics. Men as a statistical group are riskier to insure than women. The main difference in life insurance rates between men and women comes down to life expectancy. Women have a longer average life expectancy of almost 5 years when compared to men. There are several key factors to why women have a longer life average expectancy than men. Here’s how it all breaks down.

Naming Beneficiaries on Your Life Insurance Policy

Naming Beneficiaries on Your Life Insurance Policy

Naming beneficiaries on your life insurance policy is a very important part of the planning process. The last thing you want is for your death benefit to be paid to an unintended beneficiary or to leave someone out that you wanted to include. Taking the time to understand just a few important facts when it comes to naming beneficiaries can go a long way in proper planning. Here are a few important facts you should know when it comes to beneficiary designations.

The Importance of Reviewing Your Existing Coverage

The Importance of Reviewing Your Existing Coverage

You purchased life insurance. Now what? Most people buy life insurance and forget about it. In reality your existing life insurance coverage and needs should be reviewed at least every two years to ensure that your coverage goals are being met. Many factors need to be considered so it makes sense to work with an agent who is going to monitor your needs and coverage over time and not just disappear after the sale is made. Here’s how we helped a new client whose needs changed over time and the importance of a policy review.

Transamerica Trendsetter LB Review

Transamerica Trendsetter LB Review

When people think of term life insurance, they almost never think of it as a product that can provide benefits while they are still living. The fact is that most traditional term policies don’t provide many living benefits. But what if there was affordable term product that provided cash to help you pay for chronic and critical illnesses? Well look no further. Transamerica’s Trendsetter LB (Living Benefits) term life insurance product offers the affordability of a traditional term policy with access to living benefits to help you deal with any of life’s unpredictable events.

You might think that life insurance is too expensive or even out of the question if you have diabetes. Not true! You can get affordable rates if you have diabetes, but it will depend on a number of different factors. Here are some of the most important factors that are taken into consideration when an insurance company looks at an applicant with diabetes.

$1,000,000 of Life Insurance with No Medical Exam

$1,000,000 of Life Insurance with No Medical Exam

That is not a typo. Through Principal Financial’s Accelerated Underwriting Program, you can get up to $1,000,000 of coverage with no medical exam if you qualify. The program is available for all of Principal’s life insurance products and is perfect for applicants who are in good health and would like to potentially avoid taking a paramedical exam. Even if you don’t qualify, you might still be able to get preferred rates. Here’s how it works.

The US Department of Agriculture (USDA) just released its annual report, “The Cost of Raising a Child”. The report shows that a middle-income family with a child born in 2013 can expect to spend about $245,340 for food, housing, childcare and education, and other child-rearing expenses up to age 18.That figure doesn’t even include the cost of college! Who says you can’t put a price on love? See how the costs breakdown in the graphic below.

Life Insurance if You Have High Cholesterol

Life Insurance if You Have High Cholesterol

If you have high cholesterol, you might think getting life insurance could be difficult or unaffordable. Life insurance companies use different criteria for determining how they will rate applicants with high cholesterol. The good news is many life insurance companies will give you their best rating if you are currently being treated for high cholesterol but are within the normal range. If you have high cholesterol and are not on any medication, you may still be able to get a decent rate if you shop around. Here is what you need to know about life insurance if you have high cholesterol.

Why Term Life Insurance is a Great Product

Why Term Life Insurance is a Great Product

You’ve decided that it’s time to buy life insurance. Good for you! Life insurance is the foundation of any solid financial plan. But you must now decide what kind of life insurance coverage will work best for you. Term life insurance is an excellent product that allows the highest amount of coverage per premium dollar. The rates for term life insurance have decreased over time making it more affordable now than ever. When considering your life insurance options, many families need to look no further than term insurance.

Important Riders for Life Insurance Policies

Important Riders for Life Insurance Policies

Did you know that you can create a more comprehensive life insurance policy by adding various riders? Riders come at an added cost to the base policy, but can give you additional benefits that might come in handy during the life of your policy. Available riders will vary based on the insurance company, state availability and the life insurance product that you choose. The conditions that must be met to use certain riders might differ by company as well. Here is a list of some important riders that should be considered and a basic explanation of the benefit that each can provide.

Life Insurance That Pays for Long Term Care

Life Insurance That Pays for Long Term Care

Most people think that life insurance only serves its purpose at death. That is not necessarily the case. In many instances, life insurance can offer plenty of benefits that you can use while you are alive. One thing that life insurance can cover is long term care expenses. When you purchase a life insurance policy with a long term care benefit rider (LTC rider), you are able to use the policy to pay qualified long term care expenses. If you never use the long term care benefits, your policy will still allow you to leave a tax-free death benefit to your heirs.

How Much Life Insurance Do You Really Need?

How Much Life Insurance Do You Really Need?

You realize that you need life insurance. Congratulations! Now the question is…how much do you need? The last thing you want to do is leave your loved ones short-changed if you pass away unexpectedly. There isn’t a perfect method for determining how much life insurance you need as life brings many changes which could impact your needs. It’s been best described as “trying to hit a moving target”. Taking a simple approach such as a multiple of your income or just enough to cover your debts could leave your family financially vulnerable if you weren’t around to provide for them. So what method should you use?

How Expensive is Life Insurance if You’re Overweight?

How Expensive is Life Insurance if You’re Overweight?

You need life insurance but consider yourself overweight. You think that life insurance is going to be unaffordable, so you decide to wait until you lose 20 or 30 pounds before you apply or you don’t even bother applying at all. This scenario occurs often but what people don’t realize is that life insurance companies are forgiving when it comes to your weight as long as it does not come with additional health issues. So if you are interested in life insurance but are waiting until you lose those last few pounds before you apply, you should know there is a good possibility that you could qualify for affordable rates right now.

Life Insurance for Single Parents

Life Insurance for Single Parents

It’s obvious that life insurance provides essential coverage for anyone who has dependents. It can help provide the financial means your loved ones need to replace your income should you pass away unexpectedly. Single parents face an additional need for life insurance, especially if the other parent is providing limited or no financial support. According to Genworth’s 2011 Life Jacket Study, 69% of single adults with children are uninsured. This doesn’t have to be the case as life insurance has never been more affordable.

How Does Traveling or Living Abroad Affect Life Insurance Rates

How Does Traveling or Living Abroad Affect Life Insurance Rates

Insurance companies are careful about underwriting applicants who plan on living or traveling abroad in the future. With everything going on in the world today, it is no surprise that certain countries pose a higher risk to travelers and residents. Insurance companies generally classify countries on a scale that will determine if any additional underwriting consideration will be required. If you are planning on traveling to a foreign country to visit or reside, it is best to know how it might impact your rates.

Is Mortgage Life Insurance Worth it?

Is Mortgage Life Insurance Worth it?

Buying a home is a major life event that should make you consider buying life insurance if you haven’t already done so. At some point during your home purchase, you will probably be presented with an opportunity to buy mortgage life insurance. It may be by the lender or it could be by an outside company that solicits you because they know that you just bought a house. But is buying mortgage life insurance worth it?

5 Bad Excuses for Not Buying Life Insurance

5 Bad Excuses for Not Buying Life Insurance

There are many good reasons to buy life insurance, but for some reason millions in this country are either underinsured or not insured at all. If you have people who depend on you financially, chances are you need life insurance coverage. Many people who should have coverage put it off for one reason or another. Here are some bad excuses for not buying life insurance. Are you guilty of making any of these excuses?

Protective Life Custom Choice UL Review

Protective Life Custom Choice UL Review

Protective Life’s Custom Choice UL is truly a unique product. It allows you to customize a level premium and death benefit period of like a term policy. Once that period has expired, you have the option to continue the policy with more modest coverage without increasing your premiums for many years. It offers a convenient option for those who may need a smaller amount of coverage later in life without having to deal with applying for a new policy when health issues might be a challenge. The Custom Choice UL allows premium flexibility, a generous conversion feature and several optional riders that can be added to enhance the coverage. It is also one of the lowest priced options on the market. Here’s how it works.

Is Your Agent Willing to Go the Extra Mile for You

Is Your Agent Willing to Go the Extra Mile for You

During the field underwriting process, your agent should gather as much information about you as possible so that the insurance company can make the most informed decision about your health rating. For those that are healthy, the process of buying life insurance can be quick and simple. But for those who have health issues, the process can be lengthy and frustrating unless you have an agent that is willing to go the extra mile for you. What are some things your agent can do make the overall experience of buying life insurance better for you?

The Basics of an Irrevocable Life Insurance Trust

The Basics of an Irrevocable Life Insurance Trust

Typically life insurance death benefits pass tax-free to beneficiaries but are includable in your estate if you own the policy. For most, the inclusion of life insurance death benefits in their estate at death doesn’t matter since the Federal Estate Tax Exemption is $5,340,000 for individuals and $10,680,000 for married couples in 2014. Not only that, but a spouse can leave an unlimited amount to a surviving spouse without any tax implications. But for those who have amassed a large estate, it is possible to use life insurance to leverage annual gifts and pass death benefits to beneficiaries tax –free and outside their estate by using an irrevocable life insurance trust (ILIT). Here is a simple explanation of how the strategy works.

Life Insurance for Marijuana Smokers

Life Insurance for Marijuana Smokers

Marijuana is legal for medical use in 20 states and Washington D.C. and legal for recreational use in 2 states as of this post. Both numbers are expected to increase in the future. Because of this, life insurance companies have had to seriously address marijuana use by applicants when underwriting policies. The good news is that not only can you can get life insurance if you smoke marijuana, but you can possibly get preferred nonsmoker rates.

Affordable Life Insurance – 10 Small Tricks for Big Savings on Life Insurance

Affordable Life Insurance – 10 Small Tricks for Big Savings on Life Insurance

Saving thousands of dollars over the life of your policy is easier than you think. The right agent will know exactly how to save you money while still finding you a policy that best fits your needs. We have compiled a list of 10 little tricks that can be used to save money on your life insurance policy. These tips will allow you to make life insurance more affordable. Remember, most life insurance policies last a long time so any amount that you can save each year can add up to huge savings over the long haul.

Tips for a Successful Paramedical Exam

Tips for a Successful Paramedical Exam

If you are purchasing life insurance that is being fully underwritten, you will most likely have to take a paramedical exam. A paramedical exam is an abbreviated medical exam paid for by the insurance company that is administered at your home, office or an examination center. The results of your paramedical exam are important in determining the health class rating that will ultimately be given to you by the insurance company, so it is very important to get the best results possible on your exam. Here are our tips for a successful paramedical exam.

Avoid These Life Insurance Agents

Avoid These Life Insurance Agents

Finding the right life insurance agent is essential in ensuring that you get the product that best fits your needs. Every industry has its bad apples and the life insurance industry is no different. If you are trying to find the right agent, there are certain things that you can look out for that might raise a red flag. We have listed 10 things that you should look out for when working with an agent. If you are talking to an agent that is guilty of even a few of these things, it is probably best to avoid them or get a second opinion.

Prudential Term Essential and Term Elite Review

Prudential Term Essential and Term Elite Review

Prudential’s Term Essential and Term Elite products are two term life insurance products that are similar in many ways except for a couple of features. The Term Essential product is considered a simple term product for those who need affordable level term coverage that is convertible to permanent coverage in the future. Term Elite also offers affordable level term coverage but is geared for those who are going to convert to permanent coverage by offering a conversion credit if converted within the first 5 years. Let’s take a closer look at these two products and how they compare.

Does Your Job Impact Your Life Insurance Rates?

Does Your Job Impact Your Life Insurance Rates?

In one of our previous posts, we addressed how dangerous hobbies might affect your life insurance premiums. Did you know that insurance companies also take a close look at your occupation as well to determine if it is considered high risk? High risk occupations will often require a flat-extra amount to be added to the regular premium. In a previous blog post about dangerous hobbies, we talked about how a flat-extra works. Simply put, it is an extra amount per $1000 of coverage added to the base insurance premium. Here are some examples of high risk occupations and the flat-extra amounts that might be required. Actual amounts may vary depend on the actual details of your situation.

Bridging the Gap to Retirement with Term Insurance

Bridging the Gap to Retirement with Term Insurance

Many people are finding that the term coverage they purchased years ago is expiring at a point when they still need coverage. This usually happens to people turning 60 who still need coverage until they retire. When they originally purchased their term policy, they probably felt that coverage to age 60 would be long enough to cover them until retirement, but as we all know life doesn’t always go according to plan. Many continue to work longer than originally anticipated because they might have lingering financial obligations that they are trying to take care of like a small mortgage balance or they need to save more money for retirement. Purchasing term coverage could offer the protection needed to bridge the gap to retirement or longer if necessary.

Life Insurance with No Medical Exam

Life Insurance with No Medical Exam

There are several different types of life insurance products that will allow you to get coverage without a medical exam. This might sound great to those who don’t want to go through a paramedical exam but is it worth it? There are two main tradeoffs for not having to go through the medical exam – higher rates and lower coverage amounts. Because the insurance company gathers less information about you, they consider you a higher risk than if you went through the full underwriting process. Here are some important facts you should know before you consider no exam life insurance.

5 Mistakes to Avoid When Buying Life Insurance

5 Mistakes to Avoid When Buying Life Insurance

Buying life insurance involves proper planning. A simple mistake when buying life insurance can be costly to say the least. In most cases, this can easily be avoided by simply working with an independent life insurance agent who can give you objective advice and shop around for the policy that best fits your needs. We have compiled a list of 5 mistakes that people make when it comes to life insurance.

Is Employer Sponsored Life Insurance Worth it?

Is Employer Sponsored Life Insurance Worth it?

Every year when you renew your benefits at work, you are probably offered life insurance through your group plan. You might even be given a certain amount for free such as an amount equal to your salary or a flat amount of $50,000. Obviously, it is worth taking any amount that is free but what if you are offered the opportunity to purchase more coverage through your group plan? Group life insurance might be a good idea for some but you should understand all of the important facts about these plans before making your decision.

Dangerous Hobbies and Life Insurance

Dangerous Hobbies and Life Insurance

The process of underwriting does not just involve a review of your medical information. Life insurance companies also look at the lifestyle choices you make such as hobbies. These are usually called non-medical impairments or avocations. Obviously, some hobbies are considered more dangerous than others and will require an additional “flat-extra” premium amount per thousand of coverage. For example, let’s say a 20 year term policy for $500,000 of coverage costs you $750 in premium per year based on your health class. If you engage in a dangerous hobby, an insurer could impose an additional $3.50 flat extra per $1000 of coverage. So if you had $500,000 in coverage, it would result in an extra $1,750 (500 x $3.50) in premiums per year. Your yearly premiums would then be $2,500 ($1,750 + $750) for $500,000 of coverage. So which hobbies are considered dangerous and how much extra will it cost you? It really depends on the insurance company, which is why it is smart to shop your coverage with an independent agent. Here are some examples of flat-extra amounts that you might see for some of the more popular hobbies.

How do Life Insurance Health Class Ratings Work

How do Life Insurance Health Class Ratings Work